Emergency Relief Program (ERP) Phase 2 Update 1/13/23

- January 13, 2023

- Posted by: Daniel Lefstad

- Category: News

USDA released the details on the ERP (Emergency Relief Program) Phase 2 and PARP (Pandemic Assistance for Producers*) this week. ERP was designed to help producers who were affected by natural disasters in 2020 and 2021.

ERP Phase 1 was implemented last May with prefilled applications sent out to producer’s who suffered crop insurance losses in either 2020 or 2021. Producers were paid 75% of the qualifying ERP loss which was based on your crop insurance level and an ERP payment factor (ranging from 75% to 95% of the APH of your crop). When Phase 1 was rolled out, it sounded like Phase 2 would use similar criteria to handle the shallow losses (comparable to methodology used in WHIP+) that were not covered in Phase 1. As it turns out, Phase 2 isn’t anything like Phase 1 except for the same qualifying disaster years.

ERP Phase 2 takes a revenue-based approach to qualify for either 2020 or 2021 if you had a qualifying disaster event. Here are some key details of ERP Phase 2:

1. Phase 2 uses 2018 or 2019 (Can use whichever year was higher) as your Revenue Benchmark year to compare to the applicable disaster year 2020 or 2021

2. Producers will need their Schedule F income tax information to complete and submit the ERP Phase 2 application to FSA.

3. The producer will need to calculate their allowable gross revenue for both a benchmark year and applicable disaster year (A list of allowable revenue is attached on the ERP Phase 2 fact sheet)

4. To calculate payment eligibility a producer takes their benchmark year allowable gross revenue x 70% minus disaster years allowable gross revenue minus any Phase 1 payments received for the applicable disaster year

5. Phase 2 Initial payment is the LESSER of the amount calculated or $2000

6. If a producer decreased or increased their operation capacity in the disaster year, as compared to the benchmark year, the producer must certify to an adjusted benchmark revenue.

7. Producers can apply for both 2020 and 2021 disaster years and an ERP Phase 2 payment will be calculated separately for each disaster year.

8. Same payment limitations as Phase 1 will apply: $125,000 unless a person/legal entity can show that at least 75% of their AGI is derived from farming in which case the limit would be $250,000. A Separate $900,000 dollar limitation is available for specialty crops. Both Phase 1 and Phase 2 fall under the same payment limit (by year). If a producer has already maxed out their payment limit in Phase 1 they would not be eligible for any additional funds in Phase 2.

9. Signup for Phase 2 begins January 23rd and continues through June 2.

Issues we see with Phase 2:

1. Tax returns don’t necessarily reflect the crop year that the crop was produced.

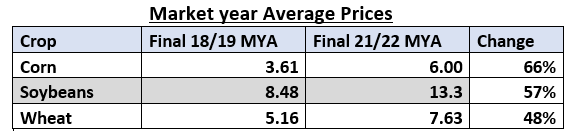

2. Utilizing 2018 or 2019 as a benchmark revenue year since there was lower production in many areas and as commodity prices were significantly lower those years (see Market Year Average Price chart below)

3. ERP Phase 2 payments are subject to available funds

4. Utilizing different criteria in the handling of Phase 2 vs Phase 1.

By taking a quick look at your 2018, 2019, 2020 and 2021 1040 Schedule F’s, you will get a good idea whether you may possibly qualify under the new rules of Phase 2. Since the benchmark revenue years had lower commodity prices and poor yields in a lot of areas, we believe a majority will no longer qualify under the current criteria vs. how Phase 1 was handled. We are going to be informing our state representatives and senators about the inequities in the handling of Phase 2 vs. Phase 1 in hopes that they may revisit the process. If you would like email/phone numbers to do the same, please contact our office.

As mentioned above, USDA also announced the details for PARP (Pandemic Assistance for Producers) this week. This program is for producers that suffered at least 15% loss due in revenue in 2020 due to the pandemic compared to a benchmark year of 2018 or 2019. Based on the allowable gross revenue, it appears that this program only covers ag products purchased for resale.

Please see the PARP & ERP Phase 2 fact sheet link below and contact us if you would like more information on how it works.

PARP Fact Sheet

www.farmers.gov/sites/default/files/documents/farmersgov-parp-factsheet.pdf

ERP Phase 2 Fact Sheet

www.fsa.usda.gov/Assets/USDA-FSA-Public/usdafiles/FactSheets/2023/fsa_erp_factsheet_22.pdf

If you have any questions please contact our office at 218-935-2700